India & Asia Steel Crisis: How Slize help save amid the rising tariff with the help of dynamic pricing

The global steel industry is the backbone of economic growth and infrastructure. It provides the material for transport networks, energy systems, and cities. Steel fuels industrial production, from cars to machinery. It enables the green transition and creates millions of jobs through its supply chains. The industry also remains vital for national security.

The main steel-producing regions are China, India, the European Union, Japan, and the United States — with India now ranking as the second-largest producer globally. With India being a significant player, particularly as an exporter, this vital sector constantly grapples with inherent complexities that often challenge traditional digital solutions

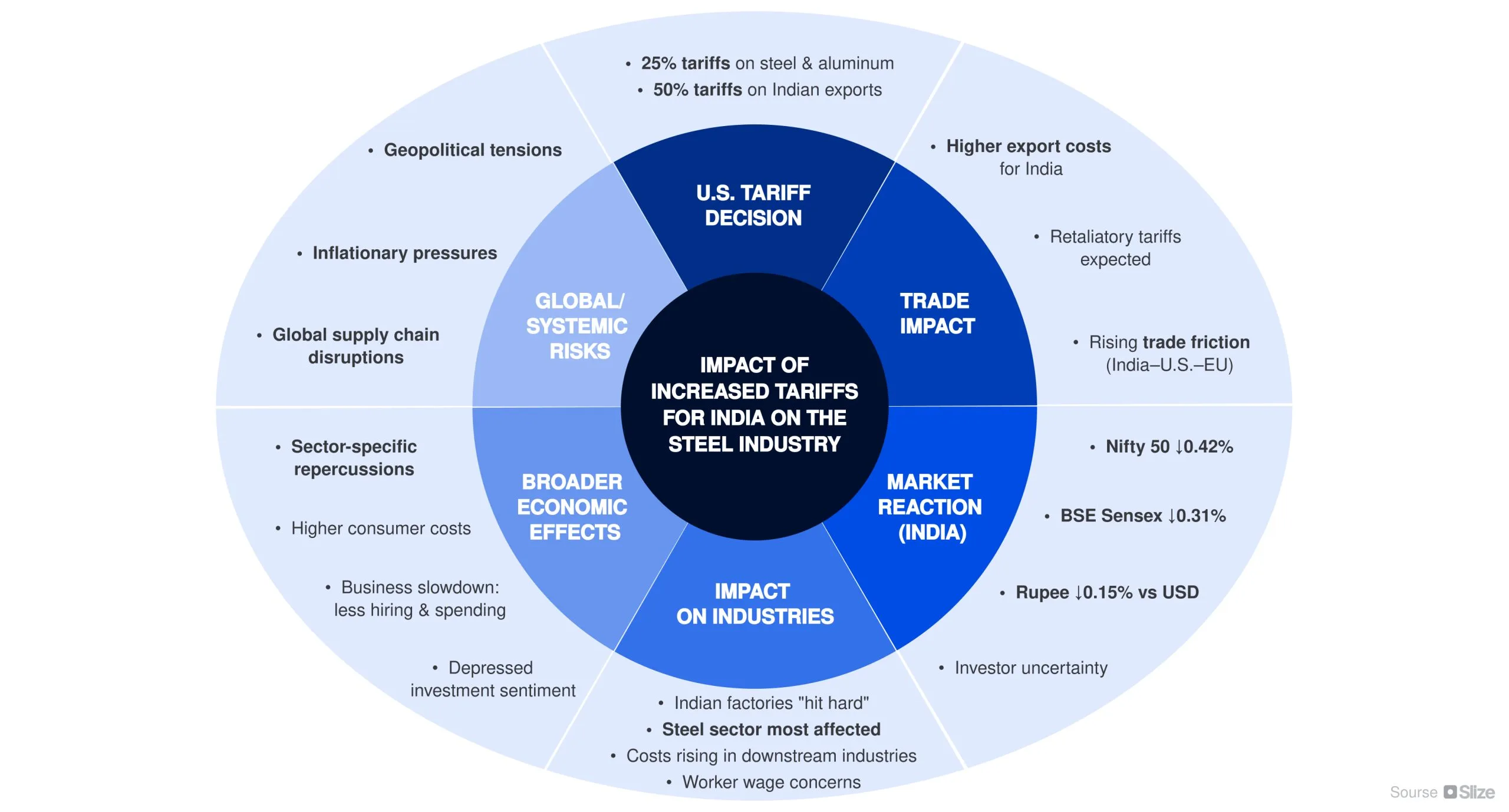

Impact of Increased Tariffs for India on the Steel Industry

The new tariffs announced by the U.S. administration, particularly those targeting steel and other Indian exports, are expected to have significant repercussions for India’s economy and its industries, including steel:

Direct Tariffs on Steel and Aluminum

The U.S. has imposed 25% tariffs on all steel and aluminum imports. These measures, reminiscent of tariffs in 2018, previously led to increased domestic production in the U.S. but also sparked retaliatory tariffs, raising costs and domestic prices for downstream industries.

Immediate Market Reaction in India

Following Trump’s threat of “much steeper tariffs,” Indian markets experienced a decline at the open on August 5, 2025. The benchmark Nifty 50 decreased by 0.42%, and the BSE Sensex was down 0.31%. Concurrently, the Indian rupee weakened by 0.15% against the dollar.

Impact on Indian Factories

BBC correspondents reported that “Indian factories hit hard by Trump’s 50% tariffs.” This suggests that specific industries within India are facing substantial financial pressure, with concerns arising such as “‘How will I pay workers?'” While not explicitly limited to steel, the context of tariffs on steel and aluminum suggests the steel industry would be heavily affected.

Broader Economic Downturn and Uncertainty

The implementation of these tariffs is expected to have “sector-specific repercussions, dampening sentiment across various industries” globally. Tariffs can lead to higher costs for consumers, with studies showing a nearly one-for-one rise in import prices largely passed on to consumers. Overall, the uncertainty associated with tariff increases depresses business sentiment, weighing directly on spending and hiring.

Source: Slize

How Much Money the Industry Might Lose

The newly announced US tariffs could inflict severe financial pressure on India’s steel and aluminum sector, with potential annual losses of up to US $2 billion from exports alone. The Indian Steel Association has warned that exports to the US may fall by as much as 85%, while broader engineering goods worth US $5 billion are also at risk due to their heavy reliance on steel. Beyond direct export losses, S&P Global projects a ₹3,000/ton (~ US $34.50) price drop in Indian steel, eroding domestic producers’ margins as global supply flows shift.

The ripple effects extend beyond steel mills. Factory owners are already voicing concerns about covering wages, while Indian markets have reacted with a weakening rupee and falling indices. Even though India’s large domestic demand could soften the blow, the combination of shrinking export revenues, price pressures, and dampened investor sentiment threatens to weigh on growth. Taken together, the tariffs risk not only billions in lost revenue but also long-term competitiveness in global steel markets.

Solutions Slize Can Offer for the Steel Industry in India and Other Asian Markets

Given the challenges posed by tariffs, market volatility, and the need for operational agility, Slize Commerce Platform offers a range of solutions that can assist the steel industry in India and other Asian markets:

Pricing and Protecting Margins in Volatile Markets

- Advanced Pricing Engine: Slize’s advanced pricing engine allows for automated adjustments, segment-based pricing, and real-time market responsiveness to optimize margins. This is crucial for adapting to tariff-induced cost changes.

- RPC (Replacement Cost Pricing) Adjustment: The platform enables instant updates to repurchasing or manufacturing costs, helping businesses stay competitive and protect margins during market fluctuations. Slize’s pricing system supports both dynamic and fixed pricing strategies essential for volatile markets, managing billions of possible price combinations for clients with tens of thousands of SKUs and customers.

- Volume-Based Price Brackets & Multi-Currency/Unit Pricing: It supports setting up quantity discounts to reward bulk buyers and offers built-in multi-currency functionality for global transactions, adapting to regional and international markets.

- Sales Tools & Dashboards: Sales teams can leverage historic price data and real-time market insights for data-driven pricing decisions, including instantly adjusting prices within the system to maintain competitiveness.

Supply Chain Disruptions and Facilitating Diversification

- Modular and API-First Approach: Slize allows businesses to compose tailored B2B webshops and commerce solutions by integrating specialized tools, custom workflows, and existing applications, including core ERP, PIM, CRM, and BI systems. This flexibility is essential for reconfiguring supply chains in response to trade shifts. This drastically reduces order entry time by 80% for clients like Damstahl, eliminating the need for extensive customer training.

- Order and Inventory Management: The platform is built to handle supply chains with multiple warehouses and complex inter-company sourcing logic across various locations or markets. It can move multi-location inventory online, ensuring orders are fully qualified for the ERP and speeding up processing times.

- Unify Data Across Systems: Slize consolidates fragmented data sources (ERP, PIM, CRM, logistics) into a single, accessible platform, ensuring consistent, real-time business insights, which is vital for managing complex global operations and seeking new markets. This is critical for multinational enterprises, like Vargus, a Slize client that operates with five different ERP systems across various countries. This ensures real-time stock, pricing, and order status updates fetched directly from all active systems, providing essential business continuity even during complex ERP migrations.

- Customer API Access: Slize provides secure API access for customers, enabling them to integrate pricing, orders, and product data directly into their own systems. This fosters stronger long-term relationships and streamlines transactions, which is beneficial when establishing new trade partnerships.

- Content & Data Management: The platform allows for managing multi-language catalogs, localized pricing, and region-specific data while maintaining a single source of truth. This is crucial for adapting product offerings and communication when diversifying into new Asian or other global markets. It also enables configuration of features like bundles, units, and cutting charges.

Operational Efficiency and Addressing Workforce Challenges

- Client Self-Service & Automation: A self-service area provides customers with instant access to orders, invoices, and pricing, streamlining operations, reducing inquiries, and enhancing efficiency through automation. This can help mitigate issues arising from a “lack of skilled labor” by reducing manual tasks.

- Fast and Intuitive Interface: Slize Commerce is designed for speed and usability, with blazing-fast navigation and intuitive flows that streamline workflows and eliminate unnecessary steps. This improves overall operational efficiency.

- Shadow a User Feature: Sales representatives can log in as their assigned customers to provide real-time assistance, ensuring seamless support and eliminating purchasing barriers.

Regulatory Demands and Sustainability (which can also influence trade relations)

- Certificates Feature: Slize offers easy access to essential industry documentation, including material compositions, emission standards, and compliance certifications. This supports regulatory adherence, transparency, and trust-building in international trade.

- Climate Calculator: This feature provides insights into the carbon footprint of purchased materials, helping businesses meet transparency demands, comply with regulations, and support customers’ sustainability goals, positioning them as leaders in sustainable practices.

10x Digital Order Growth: Damstahl, a leading steel distributor and co-developer of Slize, scaled their digital orders from 98M to 956M DKK (approx. €12M to €128M) in just 18 months

48 Full-Time Employees Saved Annually: Through automation of processes like order entry and validation, Slize saved Damstahl the equivalent of 48 full-time roles per year. This also means 80% faster order entry for sales teams.

24% Higher Profit Margins on Digital Orders: Clients, including Damstahl, saw 24% higher gross profit margins on digital orders compared to phone orders. For a company with a €300-400M turnover, this translates to a €6-8M increase in profit annually.

Let’s get in touch

For stainless steel B2B companies in India, especially those navigating the complexities of multi-ERP environments, volatile markets, and new trade tariffs, Slize offers a strategic advantage. It transforms operational challenges into opportunities for growth by providing a platform that is not only ultra-fast and deeply configurable but also integrates seamlessly with existing systems, future-proofing operations and accelerating digital maturity. By empowering sales teams, simplifying complex product and logistics management, and enabling robust client self-service, Slize ensures business continuity and delivers measurable profit gains, even in the most demanding environments.

Slize is more than a digital sales platform; it’s an operational backbone for B2B organizations in industries where product complexity, pricing volatility, and fragmented ERPs have historically hindered digital transformation.

Discover how Slize can transform your B2B sales operations, reduce costs, and accelerate your digital maturity.